Financial Goals First

As the new year is now in full force and everyone has high hopes for a better 2021, we decided to start our conversation about money from the very beginning. What would you say the beginning is? That would be ‘sitting down’, thinking and reflecting on your money goals not just for this new year but for your long-term future. There’s a lot to think about!

Monkey Brain

First, let’s give a preview of how many people wrongly think about money. We see many clients, potential clients, relatives, or just people that we hear about who are all over the place with their finances. Without having a plan in place, questions fly on what’s on the news, which stock to buy or sell, how to get into real estate as they hear their neighbor is doing or how to participate in the most recent ‘short squeeze’ of AMC, GME or BB. Hmmm, what are those? Exactly. And it’s no one’s fault, but without a plan in place, many wonder what they should do and end up doing nothing important.

Human Brain

Enter – the “Right Way”. The right way is turning off every distraction, noise, CNBC, neighbor, brother-in-law, your dog, that blog, or any market news and concentrating on yourself. Where you are, what you have, and where do you want to be? That’s it. The most difficult thing on people’s minds now becomes the easy one. And now how to do that?

One of the first things we do with potential clients is to send them a simple template for them to input their income & spending, their assets, and debts and finally their GOALS. As you notice, there are no conversations about which stock to purchase or what real estate deal to participate in; those come much later, if ever. You cannot run without walking, even though some babies start that way and then fall, learning the hard way to walk first.

Goals & Prioritization

The above system is very important to start the conversation, especially about the GOALS. We can give suggestions about typical goals they should think about (say, emergency fund or retirement). But, it is the clients’ goals and only they know how to best prioritize them and what to pursue first. However, a good advisor does help with the thinking process on this, guiding and listening to the client’s most important factors. What do you want to do, how do you want to live, when would you like to do it? These ‘non-numbers’ conversations are important to understand what’s important and sometimes clients themselves haven’t even thought about them, as the ‘outside stock market noise’ is too loud and deafening. Shush ‘market noise’ shush…

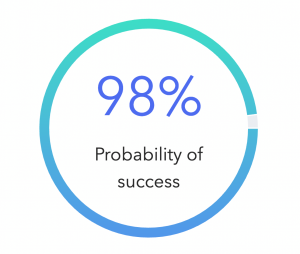

The setting of the goals is one of the most important exercises we do before we onboard a new client. We’d like to understand what is important to them, but also how we will pursue a goal to increase our chances of achieving it and not leaving it to pure chance. That is where the other parts of our template come in handy; looking at the income and spending lets us know what is available to save. We then look at those available savings, pair them with the goals the client would like to reach, and work with them to see and increase their probability of success. The asset and debts, also known as the balance sheet, let us see what you already have that can be used to fund those goals. If not much or just starting out then we know that most of the money needed for the goals will come from current savings (income minus your spending).

Shush the outside, focus on the inside

We assist with common goals by helping clients think about planning their emergency fund, debt payments, retirement funding, house down-payment saving, or similar goals. But, eventually, the client decides what goals are important to pursue, but also how to prioritize the money into those goals. The goals timeline and deciding when you want them achieved also help with designing the best portfolio for that goal. And that is how you start – by really shushing the outside and looking inside, what’s important to you and the goals you want to achieve eventually. The outside will continue to be loud and look for your attention, but now you’re focused and ‘busy’ pursuing your OWN goals. And that is exhilarating. You should try it. The world will still be loud, but to you, much quieter.